The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. Accountants help businesses maintain accurate and timely records of their finances. Accountants also provide other services, such as performing periodic audits or preparing ad-hoc management reports. The primary output of the financial accounting system is the annual financial statement.

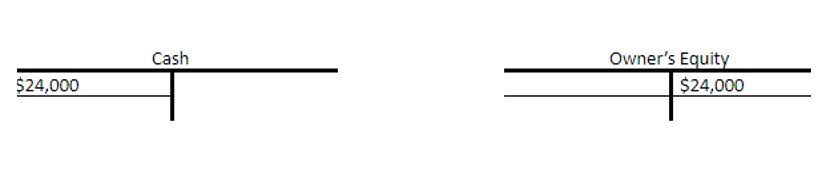

Direct Delivery’s accounting system will show an increase in its account Cash from zero to $20,000, and an increase in its stockholders’ equity account Common Stock by $20,000. There are no revenues because no delivery fees were earned by the company, and there were no expenses. A balance sheet reports a company’s financial position as of a specific date. It lists the company’s assets, liabilities, and equity, and the financial statement rolls over from one period to the next. Financial accounting guidance dictates how a company records cash, values assets, and reports debt.

Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar with accounting debits and credits as we show you how to record transactions. You will also see why two basic accounting principles, the revenue recognition principle and the matching principle, assure that a company’s income statement reports a company’s profitability. This is the practice of recording and reporting financial transactions and cash flows. This type of accounting is particularly needed to generate financial reports for the sake of external individuals and government agencies. These financial statements report the performance and financial health of a business.

The agent informs him that $1,200 will provide insurance protection for the next six months. Joe immediately writes a check for $1,200 and mails it to the insurance company. Then on the next line, the account to be credited is indented and the amount appears further to the right than the debit amount in the line above. For some, such as publicly traded companies, audits are a legal requirement. However, lenders also typically require the results of an external audit annually as part of their debt covenants.

This rule is applicable to the assets of a business, such as cash, land, what is accounting building, equipment, furniture, etc. Indirect transactions, such as staff owed wages paid through another company. Liabilities deal with what the company owes, such as accounts payable, loans payable, mortgages and payroll. To accountants, the two most important characteristics of useful information are relevance and reliability.

Our Crossword Puzzles and Word Scrambles will help you learn, review, and retain important terminology for each accounting topic in a fun way. Our Explanations simplify the most important accounting topics in a way that’s clear, straight-to-the-point, and easy to understand. With more than 25 years of teaching experience, Harold brings accounting to life by combining theory with real-world examples and stories. You will be paired with a Graduate Student Engagement professional who stays on top of the extracurricular programming that will enhance your academic journey and propel your career. Activities include boot camps on topics that are relevant to your field, professional workshops, networking events, recruiting fairs, and meet-and-greets intended to bookkeeping for cleaning business create camaraderie with your peers. Charitable institutions employ fund-based accounting to monitor funds allocated for particular objectives, guaranteeing their proper use.

As an example, assume that Direct Delivery’s van has a useful life of five years and was purchased at a cost of $20,000. The accountant might match $4,000 ($20,000 ÷ 5 years) of Depreciation Expense with each year’s revenues for five years. After five years—the end of What is bookkeeping the van’s expected useful life—its carrying amount is zero. If Joe is preparing monthly income statements, Joe should report one month of Interest Expense on each month’s income statement.

2021年04月21日