Currency trading, or forex trading, is one of the most popular forms of investment available today. With the growing global economy, traders from all over the world are eager to take advantage of the potential profits that come with trading in foreign exchange markets. The allure of currency trading lies not only in the opportunities for profit but also in the dynamic nature of the market itself. Whether you’re a novice or an experienced trader, understanding the fundamentals is crucial for success. For those based in the Middle East, it is beneficial to consider working with trusted brokers such as currency trading forex Forex Brokers in Kuwait to facilitate your trading journey.

Forex trading involves the buying and selling of currencies in pairs, aiming to profit from changes in exchange rates. Unlike stock markets, which have fixed opening hours, the forex market operates 24 hours a day, five days a week, making it accessible for traders worldwide. The market is decentralized, meaning that trades occur over-the-counter, with participants including banks, financial institutions, corporations, and individual retail traders.

In forex trading, currencies are always traded in pairs, such as EUR/USD (Euro/US Dollar) or USD/JPY (US Dollar/Japanese Yen). The first currency in the pair is referred to as the base currency, while the second currency is called the quote currency. The exchange rate between the two currencies indicates how much of the quote currency is required to purchase one unit of the base currency. Understanding this concept is fundamental as it dictates how traders make profits or incur losses.

Several factors can influence currency prices, including:

There are several strategies traders use to maximize their potential returns:

Day trading involves making multiple trades within a single day, with positions closed before the market closes. This strategy requires a sound understanding of market movements and timely decision-making.

Swing traders aim to profit from short- to medium-term market movements. They typically hold positions for several days or weeks, allowing them to capitalize on price swings.

Position trading is a long-term strategy where traders hold onto positions for months or even years. This approach relies heavily on fundamental analysis and overall market trends rather than day-to-day fluctuations.

Scalping is a high-frequency trading method that involves making numerous trades throughout the day to profit from minor price changes. Scalpers rely on technical analysis and fast execution to capitalize on small price movements.

While trading can be profitable, it also involves significant risks. Implementing prudent risk management strategies is key to minimizing potential losses. Here are some effective risk management techniques:

Selecting a reputable forex broker is vital for success in currency trading. Look for brokers that are regulated by recognized authorities, offer competitive spreads, and provide a user-friendly trading platform. Additionally, consider the availability of educational resources and customer support. Brokers operating in your region, such as those listed among the Forex Brokers in Kuwait, can offer insights specific to your market conditions and regulatory environment.

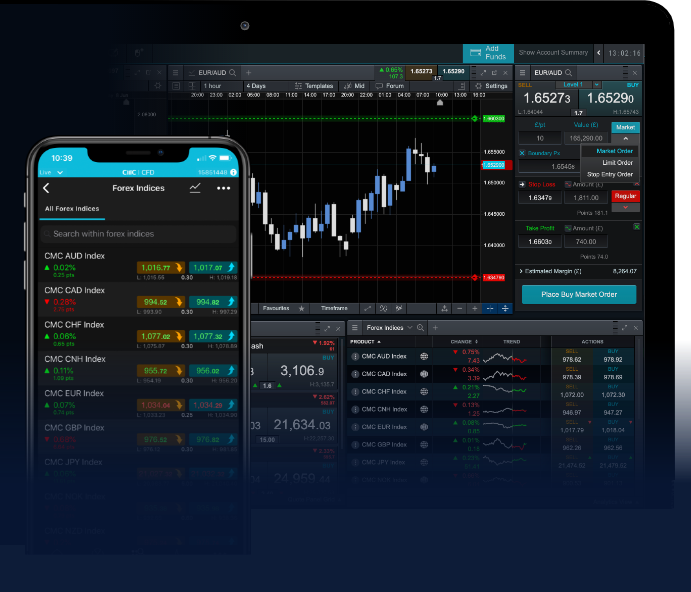

The advancement of technology has significantly transformed the forex trading landscape. Traders now have access to advanced trading platforms equipped with analytical tools, automated trading systems, and mobile apps, enabling them to trade on-the-go. Utilizing such technologies can enhance your trading experience and improve your decision-making capabilities.

Success in forex trading comes from ongoing education and practice. Many brokers offer demo accounts that allow traders to practice without risking real money. Consider taking advantage of these tools to develop your skills, learn from your mistakes, and build confidence.

Currency trading in the forex market can be an exciting and potentially lucrative venture for those willing to dedicate the time and effort to learn and develop their skills. By understanding the basics, employing effective strategies, managing risks, and choosing the right broker, traders can position themselves for success in this dynamic market. Remember, patience and continuous learning are the keys to becoming a proficient forex trader. Prepare yourself mentally and practically, and you may find yourself navigating the complexities of currency trading with confidence.

2025年11月01日